Punjab Public Finance and fiscal Policy:-

Introduction

Punjab economy was India’s leading state economy during the pre-reforms era, especially after the Green Revolution. Thus, Punjab acquired the status of being the most vibrant and prosperous state. Over a long period, Punjab remained at the first position in terms of per-capita income. The state has lost its economic glory and slipped behind many states not only in terms of per-capita income but also in other economic indicators. Recently, a debate on the issue has been initiated in academia and policy-making circles to pinpoint the causes and factors responsible for the existing scenario of Punjab’s economy. This debate has been concentrating around two lines of thought: first, Punjab itself is responsible for the below-potential performance and the present economic crisis, as mentioned in a recent report,

Consequently, the fiscal policy of the state governments was in disarray, which led to the investment collapse. Due to some vested interests, the economic freedom report tries to brand the hard realities that Punjab faced and is facing as myths. At the same time, the report also disappoints the academicians who support the cause of Punjab. Further, the report also attempts to compare the incomparable and mislead people of the country. It is highly condemnable, unfortunate and seems that campaigners of the first line of thought attempt to weaken the pressure generated on the Centre by the believers of the second line of thought for granting an investment revival package to Punjab.

Regarding the second line of thought, the common policy issues emerged that if Punjab wants to regain and achieve its lost economic glory, then the state requires diversification and structural transformation of its economy. Punjab’s economy has been facing a chronic shortage of investment in capital formation as the investment-state domestic product (SDP) ratio remained below 20%, which is 15 percentage points lower than the all-India ratio and lowest among the 14 major states of India.

Further, the investment in the agrarian economy of Punjab has continuously been declining as the investment-agriculture state domestic product ratio has reached an all-time low of 9%, according to latest available estimates. The state’s fiscal policy urgently needs a revamp, so that the low tax-SDP ratio of 7% is raised to 12% and this is possible by increasing tax compliance, elimination of tax evasion and imposition of new taxes. Universal approach to subsidies should be eschewed with immediate effect and subsidies should be provided for building capabilities of deprived/sufferer sections of society for a limited time based on the principle of social justice.

The rejuvenation of the economic development process remains the fundamental responsibility of the state government, but major and dynamic policy instruments that affect the state’s growth momentum are under the Centre’s control.

The Centre’s neo-liberal policies with regard to the external sector, decontrol of prices, tax restructuring, and many more, in fact, have played havoc with the economic growth momentum of the state. Therefore, it is suggested that the tendencies of the federal structure which are becoming more and more unitary need to be curbed as early as possible.

Key Financial Indicators

Punjab’s financial position is in dire straits for years now. Below are some Higlights:-

- During 1998-1999, there were just 10 days in the year when the State had a positive cash balance. Even this was achieved by withholding funds granted by the Union government and other agencies for specific projects.

- Revenue expenditure

increased in 2009-10 by 6%. The increase was mainly due to increase under general education, pension, assignment to local bodies and Panchayati Raj Institutions and roads and bridges.

- Punjab has faced a revenue deficit since 2007-08 since revenue growth has failed to surpass revenue expenditure.

- Punjab has the fifth highest fiscal deficit of all States which is 6% of its Gross State Domestic Product

- Punjab is the only state to have an aggregate revenue deficit of 13,580 crores from 2005 -2010.

- In Punjab, the expenditure on salaries in 2009-10 was 43% of the revenue expenditure, exceeding the norm of 35% envisaged by the Twelfth Finance Commission.

- Punjab has the highest aggregate percentage of committed expenditure as a percentage of revenue expenditure at 79% with Uttar Pradesh second at 59% in the period of 2005-2010.

- Punjab also has ‘salaries’ as the highest percentage of revenue expenditure at 33%.

Current Scenario:-

- The revenue deficit of the state was projected at Rs 14,784.87 crore for current fiscal as against Rs 11,362.02 crore for the last fiscal.

- Painting a grim picture of the fiscal situation, debt at Rs 1,95,002.05 crore for 2017-18, up from Rs 1,82,183.01 crore for previous year.

- In the wake of “poor” fiscal health highlighted in the white paper on state finances that was released in the House, the finance minister acknowledged that the government was facing the “daunting challenge of fulfilling its promises to the people of Punjab under extreme budgetary pressures”.

- Proposed fiscal deficit of Rs 23,092.10 crore (4.96 per cent of GSDP) for 2017-18, down from Rs 59,449.56 crore (13.89 per cent of GSDP) as per revised estimates of 2016-17.

- The state’s debt has been the most talked about issue for years, but that has not had any impact. It just keeps going up. Though the previous regime had shown outstanding debt as Rs 1.48 lakh crore at the end of 2016-17, the white paper brought out by the Congress government revised the figure to Rs 1.87 crore. The budget estimates for 2017-18 have pegged it at Rs 1.95 lakh crore at the end of the current fiscal.

- Revenue deficit, which indicates excess of revenue expenditure over revenue receipts, is a reason for worry. The deficit saw a slight dip in 2013-14, but has been going up since. Last year, the finance minister pegged it at Rs 7,983 crore, 1.76% of gross state domestic product (GSDP). However, it rose to Rs 11,362 crore in 2016-17 revised estimates. This year, it is estimated to go to Rs 14,784 crore. The number implies lower availability of funds for meeting revenue expenditure and increased dependence on borrowed money.

- Committed liabilities are a huge burden on the state exchequer, eating into bulk of its revenue. In financial year 2017-18, the outgo on salary, pensions and retirement benefits will eat away three-fourth of the state’s own tax revenue – Rs 31,019 crore out of Rs 39,526 crore. The salary and pensions bill has been rising consistently. The state employees get higher wages than their counterparts in most other states.

- The government has pegged the subsidy at Rs 10,255 crore in budget estimates 2017-18, up from Rs 8,966 crore, due to increased consumption and thousands of new tubewell connections

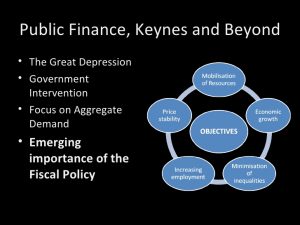

Fiscal Policy:-

Fiscal policy of the state is composed of three components — state’s own tax and non-tax revenue, revenue transfers from the Centre and the borrowings. To understand the worsening of financial position of Punjab, one has to take recourse to history. Punjab witnessed fiscal deficit of 5.3% during 1985-1990, the highest among 14 major states. In the same period, the overall fiscal deficit of the 14 major states was 3.3% and the fiscal deficit of Haryana and Maharashtra was 2.7 and 3.1% of the gross state domestic product, respectively. One fundamental reason for running a high fiscal deficit of Punjab was the relatively low revenue receipts as a percentage of gross state domestic product. This was the peak period of militancy in Punjab.

Militancy disrupted the normal functioning of almost all institutions in the 1980s, including the tax collection machinery, which is yet to be made fully functional even after two decades of democratic rule. Tax evasion is still rampant. Given the central government transfers, the state government resorted to borrowings to fulfil its committed expenditure needs. Therefore, the result of this policy was accumulation of debt burden.

Centre’s new policy

When the Centre adopted new economic policy in July 1991, several changes such as dismantling internal and external controls, reduction of tariff barriers and change in the tax structure reduced the revenue collection of the Centre. It is evident from the finance commission reports that the proceeds of the shareable taxes transferred to the states declined. During the 1990s, the state governments, on the one hand, faced the reduced supply of funds from the Centre, and on the other hand, due to change in tax structure their own tax revenue collection declined.

This double shock impinged heavily some of the states like Punjab which had already accumulated high debt burden. In 1994-95, the Centre further made amendments in the policy of lending to the states and states had to shift to commercial borrowings. The market interest rate charged on borrowings multiplied debt burden of the states in general and Punjab in particular. When the changed tax structure started giving dividends to states, some states recovered quickly from the fiscal stress but Punjab could not recover due to accumulated high debt burden on the one hand and its inability to raise its own tax revenue on the other because of near-breakdown of tax collection machinery in the state.

Long financial constraint

Further, the two-decade-long financial constraint led to collapse of investment-GSDP ratio (social overhead capital), which amounted to reduction in the future capability to produce higher level of output. The state plan documents testify this when we compare low level of plan outlay of Punjab compared with neighbouring Haryana. The cut in expenditure of Punjab adversely affected the developmental and human capital (health and education) expenditures. The liberalisation strategy of economic development provided ideological support to downsizing the public sector along with minimalist state intervention in economic activities.

The emphasis of the state was shifted to promoting business interest without any regulations on it. The payments made to the employees in the government sector have been regarded as burdensome activity without realising that social returns of expenditure on social overhead capital are very high without which the private investment cannot thrive. The decline of social overhead capital increased cost of doing private business multiple times and symptoms have been reflected in farmers committing suicides and some of industrial activities/towns such as Batala disappearing from the industrial map of Punjab. In addition, a large amount of new investment opportunities such as information and communication technology revolution has also bypassed Punjab.

Future:-

- According to a State Bank of India report, the waiver for up to 10.25 lakh farmers will cost Rs 24,000 crore and may push Punjab’s fiscal deficit higher by 4.8 percent.

- Constrained by the state’s fiscal crisis, the state government is counting on the Goods and Services Tax (GST) that kicked on July 1, with the hoping that revenues of state would double in the next years due to 14% increase promised by the Centre. Being a consumption state, Punjab is expected to benefit from the new tax regime.

- A major source of revenue for long, the real estate sector hit by slowdown is on the government radar. A massive 3% cut in stamp duty, reducing it to 6% from the existing 9%, is likely to give a boost to demand and help revive the sector. The relief will remain in place till the end of the current year.

The way out:-

There are several ways through which the state finances can be fixed and economic development process can be restored.

There should be removal of restrictive fiscal rules. The major responsibility lies with the state government to make corrections in the fiscal policy that can increase revenue based on the principles of progression. The borrowings can be done only for those investments where the social rate of return is higher than the cost of borrowings. Controlling tax evasion which will be helpful in raising own tax revenue is one of the most legitimate options with the state government.

To tide over the unprecedented crisis, Punjab’s economy needs, deserves and demands from the Centre not only the long-pending debt relief package, but a capability-building investment revival package. This package must at least cover the investment deficiency gap between Punjab and Indian economy based on the difference of investment-gross domestic product ratios. The proposed investment revival package worked out to the tune of Rs 11,000 crore per annum for five years will rejuvenate Punjab’s economy. This will also lay down the road map for states’ long-awaited structural transformation from agrarian to industrialised economy, along with ensuring food safety and security of the national economy.

Final Destination for Punjab PSC Notes and Tests, Exclusive coverage of PPSC Prelims and Mains Syllabus, Dedicated Staff and guidence for Punjab PSC PPSC Notes brings Prelims and Mains programs for PPSC Prelims and PPSC Mains Exam preparation. Various Programs initiated by PPSC Notes are as follows:-

- PPSC Mains Tests and Notes Program

- PPSC Prelims Exam 2024- Test Series and Notes Program

- PPSC Prelims and Mains Tests Series and Notes Program

- PPSC Detailed Complete Prelims Notes